The Northern Powerhouse is a regional grouping, of the North East, the North West, Yorkshire and the Humber and North Wales. First coined by the coalition government of 2010-2015 to drive investment in skills, innovation, transport and culture in northern regions of Great Britain. Five years on from George Osborne’s speech, the project is fully underway. However, figures from 2018 show the value of construction contracts awarded in this region totalled £13.2 billion in 2018, a decrease of 24.0% from the previous year.

The ‘Regional Construction Hotspots in Great Britain’ is an annual report from Barbour ABI and the Construction Products Association (CPA) which provides a regional analysis of construction contract awarded in 2018, accounting for local trends and particularities that aren’t always reflected at a national level. By analysing the value of contracts in regions across residential, infrastructure and commercial sectors, the report identifies ‘hotspots’ and ‘coldspots’ as pockets of growth or contraction over the near-term horizon.

In terms of overall contract awards in the Northern Powerhouse, Durham, North & North East Lincolnshire, and Conwy & Denbighshire were hotspots, whilst Sheffield, Blackburn with Darwen, East Lancashire, and Chorley & West Lancashire were coldspots.

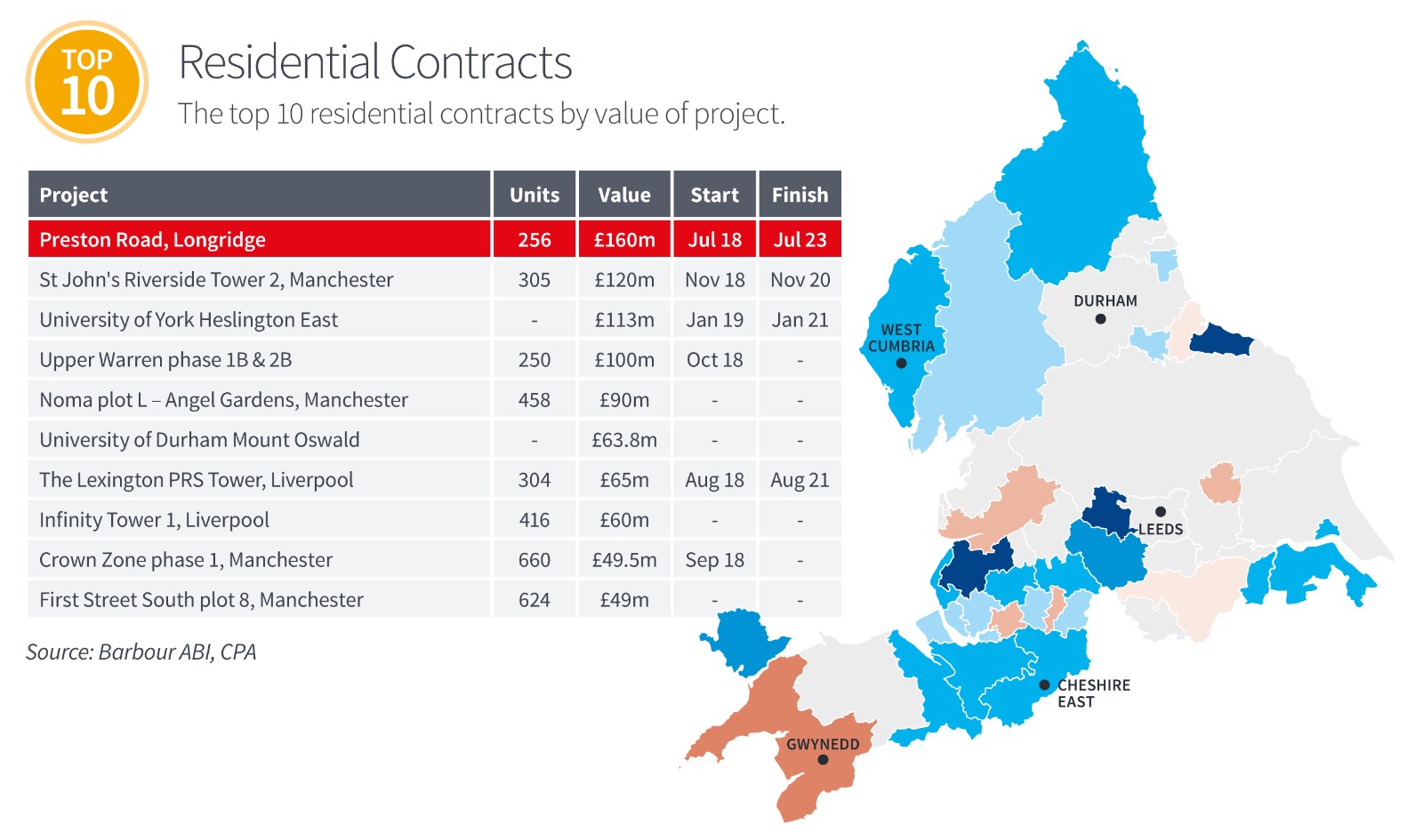

Focussing on residential contract awards, these totalled £5.8 billion in 2018, falling 13.1% from the previous year. Gwynedd was the sole hotspot. Liverpool featured in the top ten contract awards with two residential towers in 2018: the £65 million Lexington PRS tower and the £60 million Infinity Tower 1, part of a planned triple-tower development in the city centre. The largest contract award was in Preston, Mid Lancashire, for £160 million, which was the Preston Road development of 256 houses, alongside a neighbourhood centre and retail units.

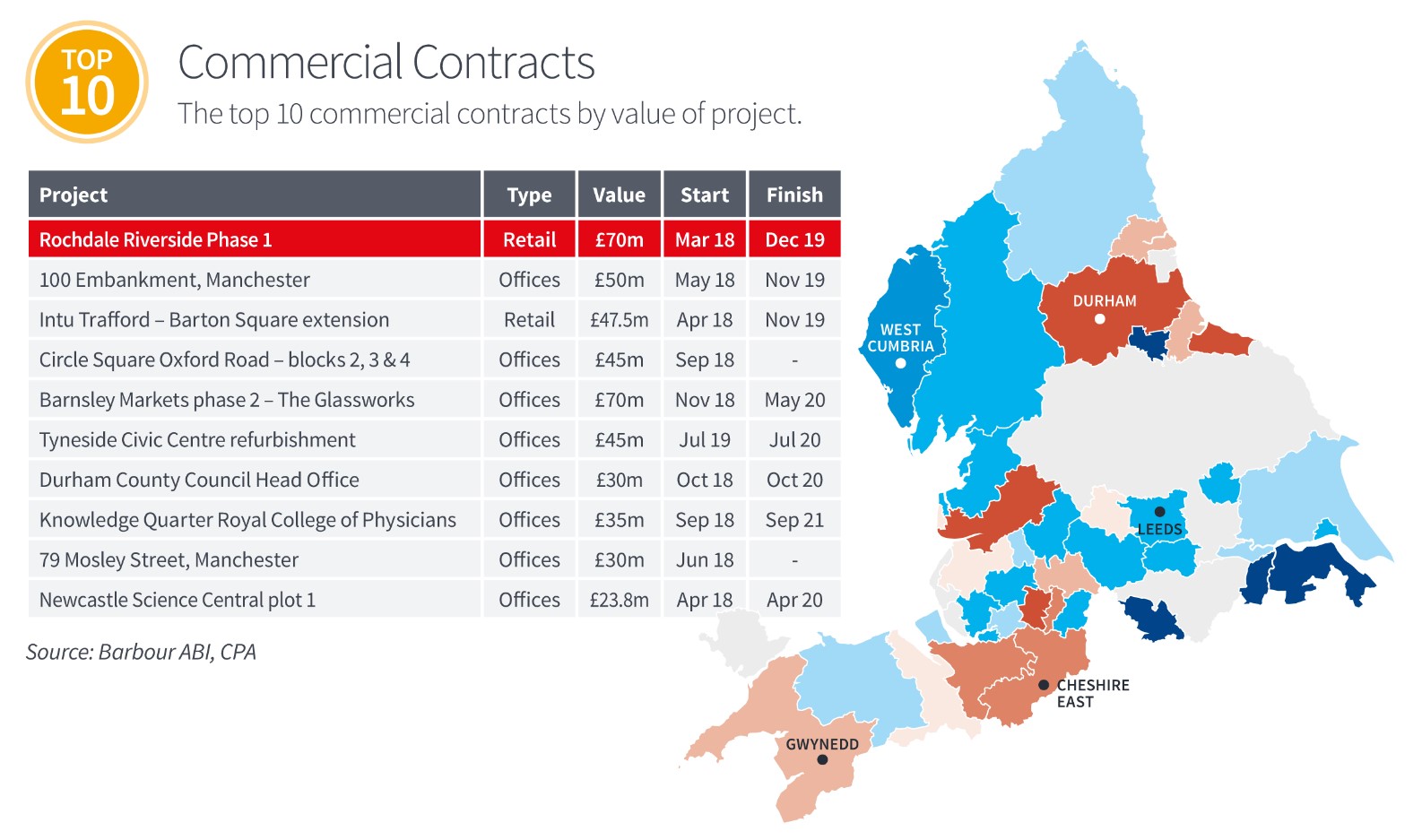

Commercial contract awards were valued at £1.3 billion in 2018, a decrease of 19.5% compared to 2017. Northern Powerhouse hotspots were Durham, South Teesside, Cheshire East, Cheshire West & Chester, Greater Manchester South West, Manchester, and Mid Lancashire. The largest contract was for the first phase of the Rochdale Riverside regeneration comprising a £70 million retail and leisure complex.

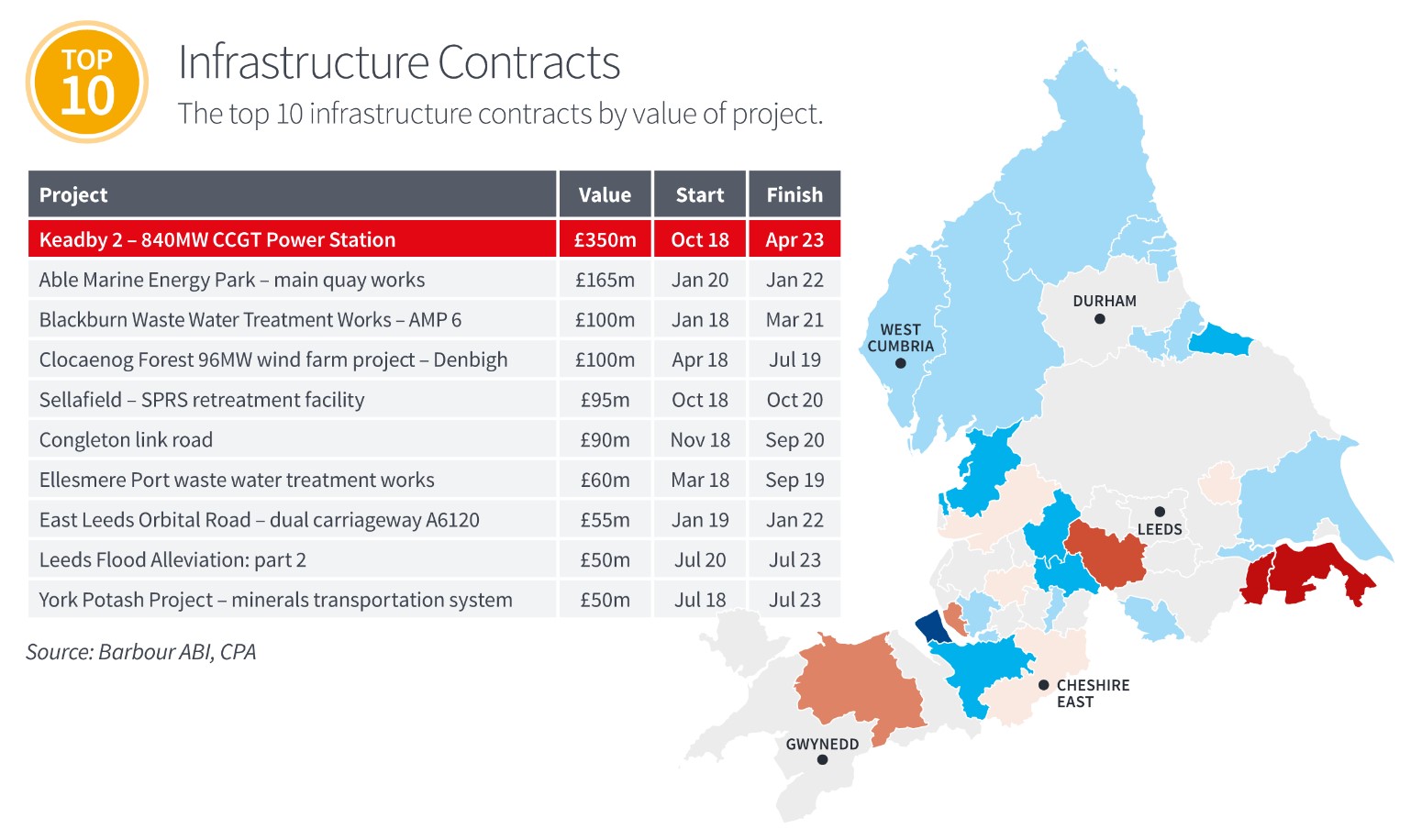

Infrastructure contract awards totalled £2.1 billion in 2018, a 59.3% decrease from 2017, which included the country’s largest contract award in Leeds (the TransPennine Rail route upgrade). In 2018, hotpots were in Liverpool, Calderdale & Kirklees, Conwy & Denbighshire, and North & North East Lincolnshire, which includes two of the top ten largest infrastructure contracts in the country: the £350 million Keadby 2 combined cycle power plant near Scunthorpe and the £165 million main quay works for the Able Marine Energy Park at the Port of Humber.

Tom Hall, Chief Economist at Barbour ABI, commented: “The Northern Powerhouse scheme was set out to build the economy, but at a first glance, these figures do not seem to reflect the ambitions of the strategy. All three sectors have seen a decline in 2018, infrastructure contract awards have seen the most substantial decrease at 59.3%, despite two of the top ten largest national infrastructure projects being in this region. However, there are several hotspots in the regions, particularly in the commercial sector. The majority of this growth was due to the warehousing subsector which saw a large increase in new contracts as consumer activity continued to move away from the high street.”

Rebecca Larkin, Senior Economist at the CPA, commented: “The clear intent of establishing the Northern Powerhouse to rebalance the UK economy away from the traditional southern engines of growth has been dulled by the smaller pipeline of projects that has emerged across the constituent regions over the last 12 months. As the region comes back to the political fore, and following the broadening of the ministerial remit, a focus on driving capital investment in infrastructure would help support wider growth opportunities for commercial and residential development as well.”

Download the full report here

Related Blog Articles

crop192.png)