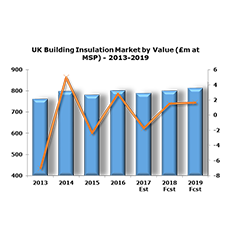

The building insulation market has been volatile since 2013, but looks set to stabilise and grow from 2018 onwards.

In 2013 the market experienced a sharp decline in value following the end of the Carbon Emissions Reductions Target (CERT) and the Community Energy Savings Programme (CESP), which incentivised the retrofitting of insulation, in 2012.

At the end of 2013 the Green Deal and Energy Companies Obligation (ECO) were introduced, but these did not achieve the name number of retrofitting installations as CERT and CESP. The market did return to growth in 2014, as the Green Deal and ECO schemes gained some momentum, and the number of new housing starts continued to rise.

However, in 2015 the government announced that the Green Deal would be scrapped due to low take up. The market has become somewhat more static in recent years and is set to see consistent yet modest growth going forward.

The product mix within the insulation market has seen change in recent years. PIR/PUR products now hold the largest market share, this is in large part due to a combination of thin profiles balanced by high thermal performance and ease of handling on site.

Arguably, the largest building market for PIR boards is flat roofing where they have the dominant market share. The market value of mineral wool products has reduced due to the fall in demand for such products under the Green Deal and ECO, but they still account for just under a third of the insulation market by value.

Polystyrene foam products represent the next largest product group consisting of EPS and XPS boards, blocks and sprayed foam.

The remainder of the market is made up of phenolic foam boards, which are widely used on technical and industrial applications but less so for building fabric, and ‘other’ insulation products including foil sheets, nitrile rubber sheets and cellulose.

The building insulation end user market shares have also changed over recent years. The dramatic fall in demand under the Green Deal and ECO compared to CERT and CESP means that the domestic retrofit market no longer represents the largest end use sector, now accounting for less than a third of insulation installed by area. This has resulted in the non-domestic market having the largest share by end user, mainly flat roofs and site-built metal cladding and roofing systems.

Additionally, new housebuilding has a larger share than in recent years, accounting for approximately the same amount of the market as domestic retrofitting, due to steadily rising numbers of housing starts and completions.

The key supply route for insulation products is the specialist (interiors) distributor channel. Builders merchants account for just below 20% of the market, the remainder being split between direct sales to installers, direct sales to external wall insulation systems companies, converters and DIY stores.

The installation market for insulation is polarised between a small number of national companies and many regional and local independent firms, with the leading contractors typically provide additional energy efficiency services.

Looking forward, the market for building insulation products is likely to be comparatively less volatile, though a modest decline is forecast for 2017. Overall, modest growth of 1-2% per year is expected over the next few years, in value terms.

Key trends over the next few years include; a decline in output for key non-domestic construction sectors, slower growth in new housebuilding compared to 2016, limitations in Government funding and new schemes to support installation, reduced levels of consumer and business confidence due to uncertainty regarding the EU exit situation.

This report is published by AMA Research, and is available now at www.amaresearch.co.uk or by calling 01242 235724.

For more on Thermal Insulation check out or Insulation Product Hub

Related Blog Articles