As UK house prices rise and hybrid working reshapes daily life, more homeowners are choosing to improve their current homes rather than move. Eurocell’s latest research reveals how this trend is shaping demand for home improvement and space optimisation across the country - creating real opportunities for the construction supply chain.

A survey of 1,000 homeowners uncovers why space is at a premium, what people are planning to do about it, and how they’re funding those changes.

Changing Lifestyles, Growing Needs

Lifestyles have changed dramatically since the pandemic, and for many, the homes they bought years ago no longer meet their needs. According to the survey:

• 29% say their home is too small

• 43% have unusable space they want to convert

• 60% will fund renovations through savings

• Only 15% of Baby Boomers feel short on space, compared to 52% of Gen-Z and 40% of Millennials

Whether it’s a new home office, space for adult children, or a hybrid work setup, homeowners are feeling the squeeze - especially in urban areas. The trend isn’t just about square footage; layout and usability are key. Many period homes, for example, have large but underused dining rooms or out-of-date conservatories.

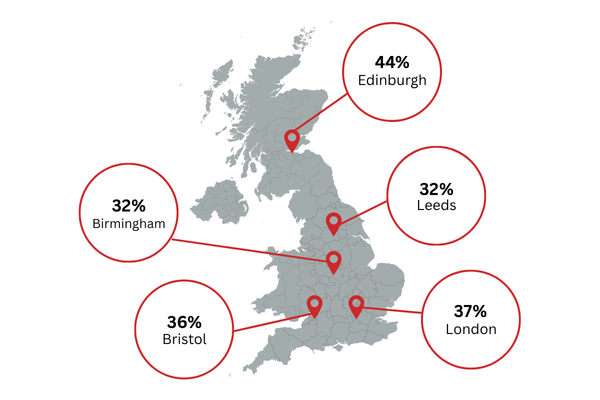

Regional Variation: Where Demand Is Highest

Not all cities feel the same pressure - and the survey offers insight into where demand is strongest for certain types of home improvement:

London

With average prices nearing £687,000, 37% of Londoners say their home is too small.

• 53% want to convert unusable space

• 36% are considering an extension

• 30% are looking at garden rooms

Edinburgh

The highest space dissatisfaction (44%) was recorded here.

• Home extensions and garden rooms top the list

• Millennials are driving most improvement plans

Bristol & Manchester

High house prices and hybrid working fuel the need for more flexible space.

• 36% of Bristol residents say their homes are too small

• 43% of Mancunians prefer to improve rather than move

Birmingham

More than 45% of residents have unusable space

• Loft conversions, garden rooms, and conservatory upgrades are popular

Liverpool & Newcastle

Residents in these cities are among the most content with their space — but there’s still demand for modernising and reconfiguring existing layouts.

What Homeowners Want to Build

The data shows a broad appetite for home extensions, loft conversions, and energy-efficient garden rooms, especially among younger homeowners.

• 47% of Millennials are interested in extensions

• 38% across Gen-Z and Millennials would opt for garden rooms

• 1 in 5 Millennials are considering a conservatory or conservatory upgrade

Interestingly, even Baby Boomers are looking to expand - likely due to multigenerational living or a desire for flexible space for grandchildren or hobbies.

How Are They Funding It?

Despite economic uncertainty, more than a quarter of respondents say they feel confident funding renovations - particularly as they view their homes as sound investments.

• 60% plan to use savings

• 17% will use credit cards

• Among Gen-Z and Millennials, over 30% expect to rely on credit

This insight into funding choices helps suppliers and contractors position their services and payment plans accordingly.

For professionals working in planning, construction, and product specification, this trend signals clear areas of opportunity.

Product Manufacturers & Suppliers

• High demand for energy-efficient upgrades like insulated garden rooms and conservatories

• Messaging should focus on quick builds, low disruption, and planning permission flexibility

• Target Millennial and Gen-Z homeowners, especially in cities with high space pressure

Architects, Designers & Surveyors

• Focus on space optimisation, especially in period homes

• Hybrid working means layouts must support flexible zones for living, working, and entertaining

• Offer smart redesigns that convert underused or poor-quality space

Contractors & Installers

• Renovation and retrofit work - not just new builds -is growing

• Regional targeting is essential: focus on cities where dissatisfaction is highest

• Offer solutions that minimise disruption and help customers navigate planning

Explore the Full Data

The full report includes a detailed regional breakdown and insights by generation, home type, and budget: www.eurocell.co.uk/blog/no-space-like-home

View the interactive survey dashboard:

charts.censuswide.com/J15216CWRS

Final Thought

Homeowners may be staying put, but they aren’t standing still. With planning applications increasingly tied to home extensions and conversions, the opportunity for built environment professionals is clear: align with the "improvers" and support them in creating homes that better reflect the way people live now.

To learn more about how Eurocell can support your housing projects, contact today: commercialsales.profiles@eurocell.co.uk

No Space Like Home: A Nation of Movers – Or Improvers?

| T | 03301 737 159 |

|---|---|

| E | marketing@eurocell.co.uk |

| W | Visit Eurocell's website |

| Eurocell Head Office and Distribution Centre, High View Road, Alfreton, Derbyshire, DE55 2DT |

Categories

Conservatories Residential buildings