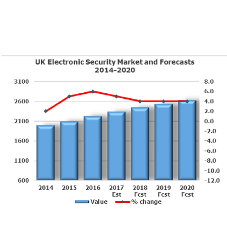

The total UK electronic security market, comprising of products - electronic access controls, intruder alarms and closed circuit television (CCTV) - and associated services, was estimated at approximately £2.35bn in 2017. This was an increase of around 5% during the year, and followed two years of strong growth in 2015 and 2016. Growth was driven by technological advancements boosting replacement demand, and improving new build and RMI expenditure across key market sectors.

CCTV accounts for the majority of the market in value terms, with a 52% share. This sector has seen the greatest levels of innovation and new product development, and the recent shift in focus by major Chinese manufacturers from cost to technological development has eased the level of price competition over the last year or two. Technology has also become more affordable, leading to a continued shift away from analogue to digital products.

In the access control sector, product development and wider availability of products have been a key driver of growth as has the performance of the UK construction sector, particularly in commercial offices and housebuilding. In addition, access control products have not been subject to price deflation experienced in other sectors, thereby enabling relatively consistent value growth.

The intruder alarm market experiences long replacement cycles and a high level of competition in relation to other security options, particularly in the non-residential sector. However, in the residential sector, growth has remained positive in line with increased housebuilding and product development focused on ease of installation.

The prospects for the electronic security sector overall are reasonably good. Value growth is likely to come from increasing adoption of new technologies in both the new and replacement sectors. While construction output growth is expected to ease over the next 2-3 years, output remains relatively high by historical standards and this should continue to provide opportunities for manufacturers and installers of electronic security equipment.

While industry sources report that price pressures have eased somewhat in the last couple of years, the focus on service packages and securing longer term revenue is expected to continue. Specifiers will also continue to focus on the whole life cost of the electronic security system, including replacements, add-ons and management costs, which will influence their choice of products and operating systems. These factors should drive the wider uptake of IP, wireless technology, analytics and cloud-based services.

This report is published by AMA Research, and is available now at www.amaresearch.co.uk or by calling 01242 235724.

Related Blog Articles